Capturing regional nuances with a global linked model

Author

Melissa R. Brown, CFA

Head of Investment Decision Research

Many risk model users may prefer the simplicity of using a single equity factor model.

A very broad model, however, may be misaligned with the portfolios, and therefore may miss some of the important nuances that can help risk estimates be more accurate, attribution more intuitive and most importantly drive better performance.

An equity factor model that links risk estimates from different regions can achieve the same goal of evaluating a global portfolio, while retaining regional distinctions that may be important. For example, factor returns might vary in one region versus another, as the economic and financial characteristics that drive them might be quite different. However, a global model would only view factor returns and volatility across all regions instead of recognizing returns are not completely correlated from one region to another, and factor volatilities will likely be different as well, thereby capturing portfolio risk more accurately.

What can an equity factor linked model see?

In addition, like the proverbial "if I put one hand in ice water and the other in boiling water, on average I'm comfortable", risk analysis for a multimanager portfolio that uses a global factor-based risk model may see no exposure to a factor when in fact one sleeve has a positive exposure and the other a negative one.

In this post, we will evaluate that last scenario with a simple example. We created two long-only Value portfolios targeting 3% active risk. The first used the STOXX Global 1800 ex USA Index as the benchmark and the investment universe, and the Axioma Fundamental Developed Markets ex-US Equity Factor Risk Model - Medium Horizon (AXWW4-MH). It sought to maximize a positive exposure to the Value factor but had no other constraints other than being fully invested. The second portfolio sought to minimize the exposure to Value (i.e., maximize a negative exposure) by targeting the STOXX USA 900 and using the Axioma Fundamental US Equity Factor Risk Model - Medium-Horizon (AXUS4- MH), also with no other constraints.

We then combined the two with equal weights and used two different global models to assess the risk: the Axioma Worldwide Equity Factor Risk Model - Medium-Horizon (AXWW4-MH) and the Axioma Worldwide Equity Linked Factor Risk Model (AXWWLM4), which combines the US, Developed Markets ex-US and Emerging Markets models. We ran our tests for the five years ended June 2020. The universe of stocks evaluated is roughly the same, but the Linked Model recognizes that there is a Developed Markets Value factor and a US Value factor1 when evaluating our combination portfolio.

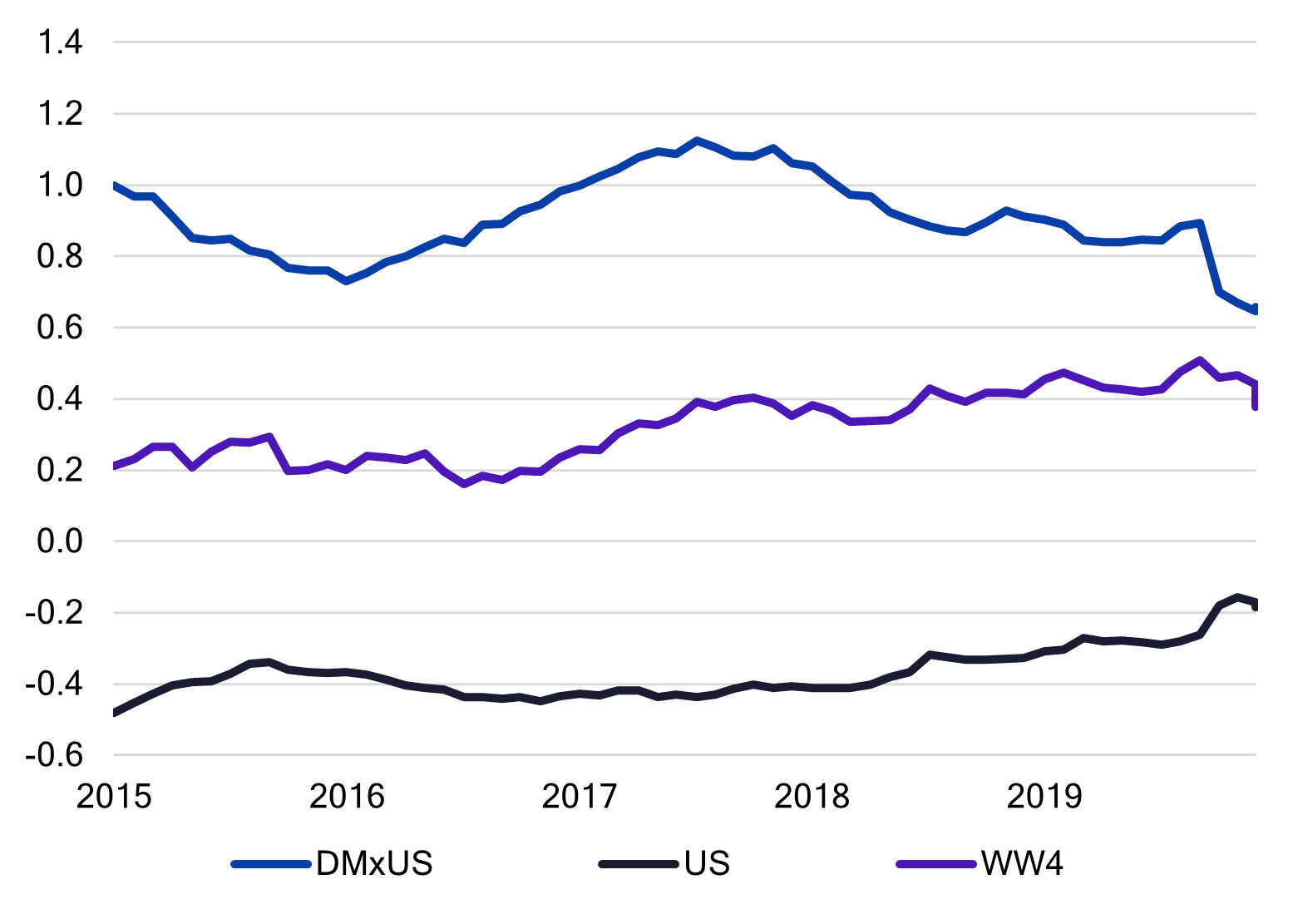

By definition, we should see a positive exposure to Developed Markets Value and a negative exposure to US Value2, which indeed we do (Figure 1). However, the Worldwide Model completely misses that nuance and tells us that our combination portfolio has very little Value exposure.

Figure 1: Value exposures of Axioma Worldwide Linked Model vs. Axioma Worldwide Model

Source: Axioma Worldwide Equity Linked Factor Risk Model, Axioma Worldwide Factor Risk Model, Axioma US Factor Risk Model, Axioma Developed Markets ex-US Factor Risk Model

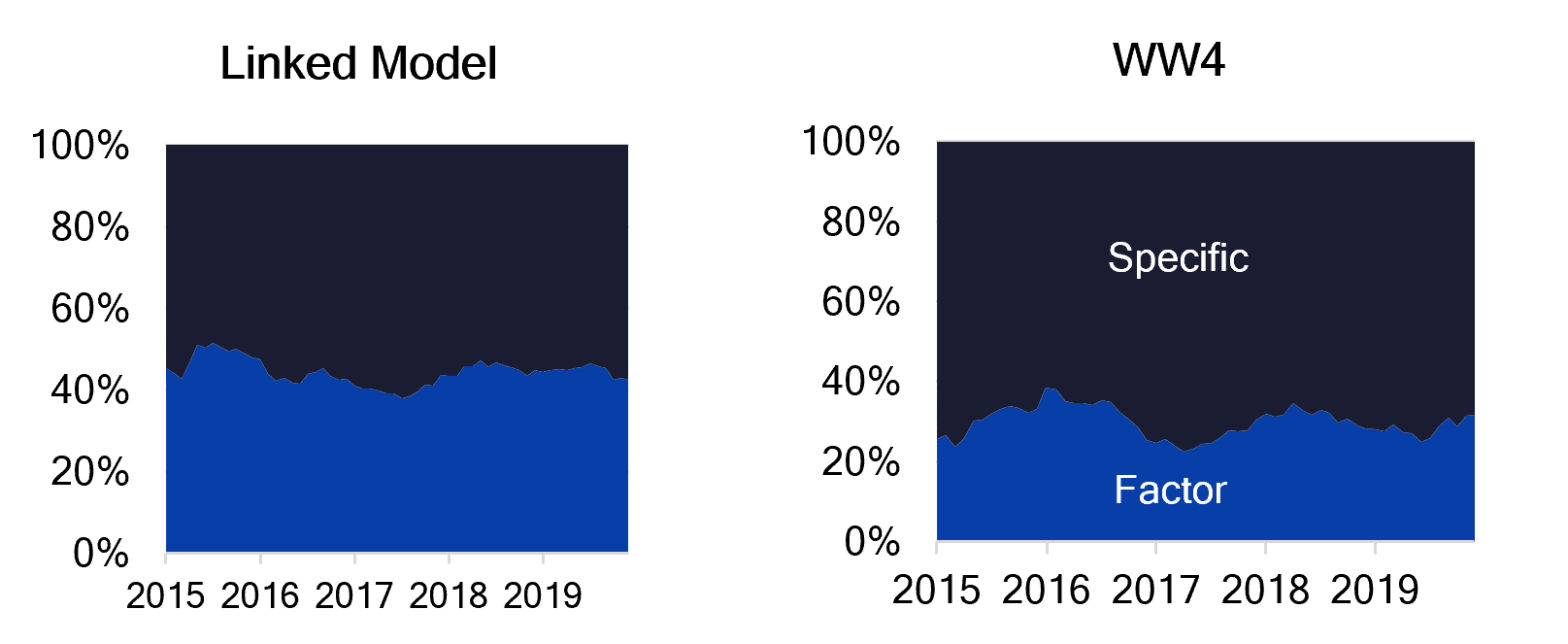

Presumably, the distribution of risk will be different if the Linked Model recognizes the exposure to Value that the Worldwide-only model does not. We created a benchmark that also equally weighted the underlying US and Developed Markets ex-US benchmarks and dug a little deeper into the active risk forecasts. Because AXWW4 saw so little exposure to Value, the Linked Model saw about 50% more risk coming from factors (44% vs. 30% on average, Figure 2).

Figure 2: Percent of active variance

Source: Axioma Worldwide Equity Linked Factor Risk Model, Axioma Worldwide Factor Risk Model

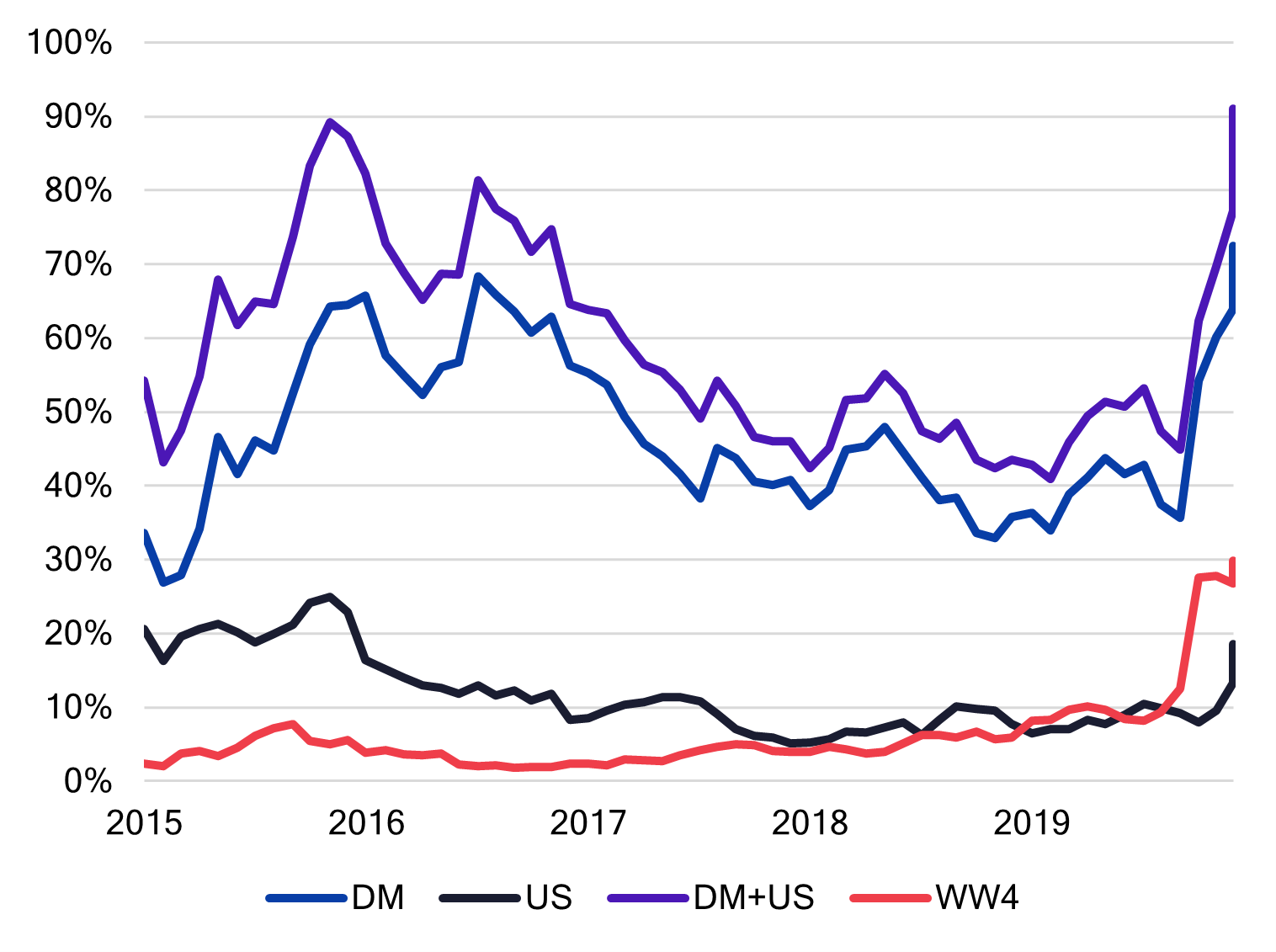

And much of that difference came from the exposure to Value. In the Linked Model, Value accounted for between 40% and 90% of the overall risk of the portfolio (driven mainly by Developed Markets' positive exposure), whereas according to the Worldwide Equity Factor Risk Model, it was as little as 2% of the risk budget and only 30% at most (Figure 3).

Figure 3: Value as a percent of active risk

Source: Axioma Worldwide Equity Linked Factor Risk Model, Axioma Worldwide Factor Risk Model, Axioma Developed Markets Equity Factor Risk Model, Axioma US Equity Factor Risk Model

A look at factor attribution

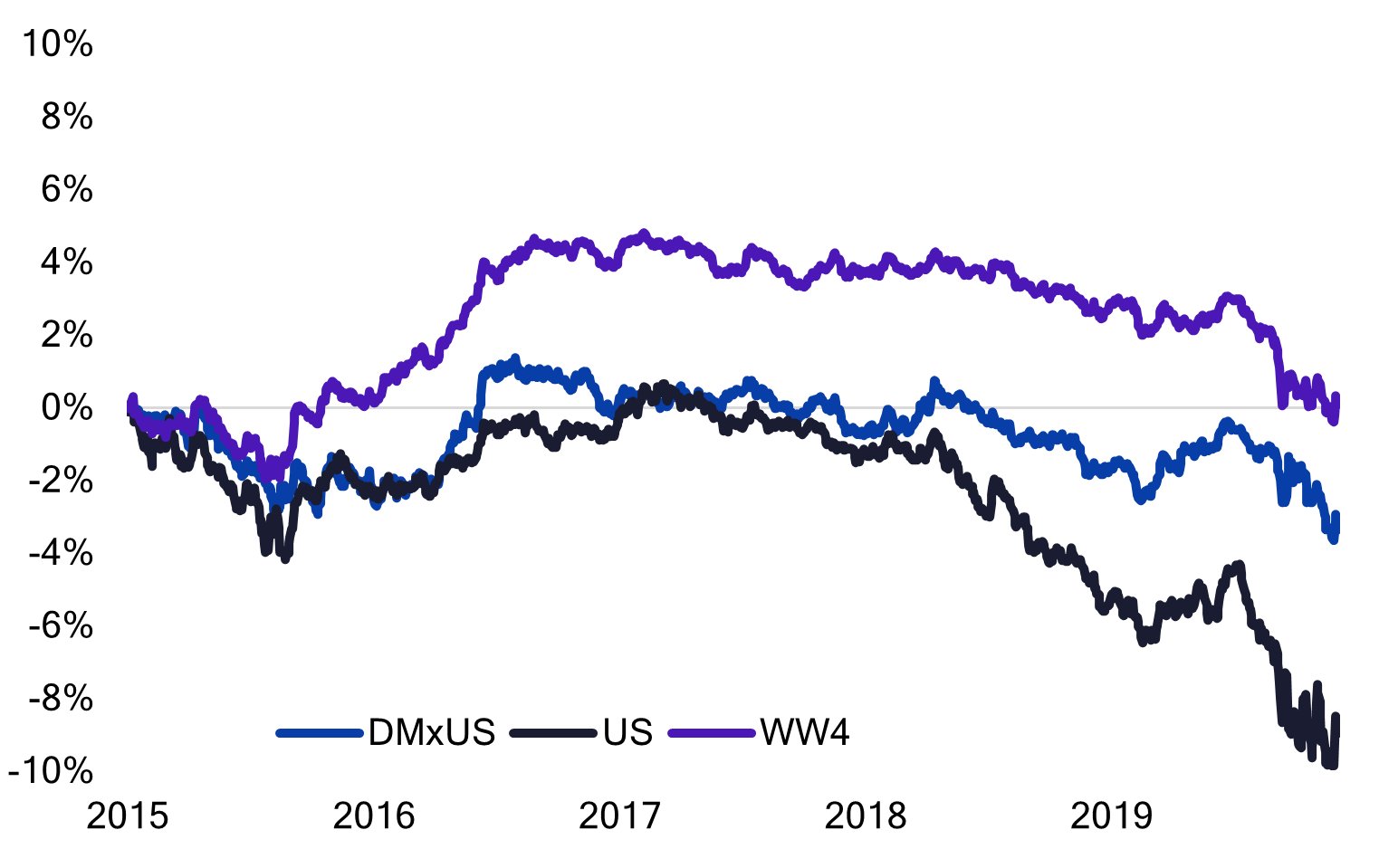

Finally, for this short study we also looked at attribution. Over the five year period our portfolio outperformed the benchmark. The Linked Model allows us to see the separate impact of our two Value tilts (along with the other incidental bets, some of which had a big impact on performance). We know that Value has struggled, but its return has been much worse in the US than outside the US over our five-year test period. In addition, the return has been quite different in the AXWW4 model than in either of our sample portfolio's component regions (Figure 4).

Figure 4: Cumulative return to Value factor

Source: Axioma Worldwide Equity Linked Factor Risk Model, Axioma Worldwide Factor Risk Model, Axioma Developed Markets Equity Factor Risk Model, Axioma US Equity Factor Risk Model

Attribution allows us to see the benefit of having been underweight Value in the US over this period, and the detriment of our overweight outside the US. We also see the impact of a few other bets, such as a drag on return from a positive exposure to Leverage in the US, more than twice the impact of the similar exposure in the global equity risk factor model. This kind of granularity can help a manager, manager of managers, or risk manager understand much better what various components of the overall portfolio have contributed.

Figure 5: Five-year performance attribution, June 2015 through May 2020

Source: Axioma Worldwide Equity Linked Factor Risk Model, Axioma Worldwide Factor Risk Model, Axioma Developed Markets Equity Factor Risk Model, Axioma US Equity Factor Risk Model

A linked model digs a bit deeper

We have shown a simplified example of the benefits of using a model that links together models in underlying regions when the portfolio has been constructed regionally rather than globally. Because a single global model may "summarize" risk too much, by not recognizing that factors3 are not perfectly correlated around the world, it may miss a lot of the nuance that goes into portfolio construction and evaluation.

References

- There is also an Emerging Markets Value factor, of course, but our test portfolio only included Developed Markets. The same holds for all the style and industry factors in the models.

- Because the US portfolio is long only, there is a limit to the achievable negative exposure since stocks can only be "short" up to the benchmark weight. Therefore, the magnitude of exposure is low relative to positive exposure of the developed markets ex-US portfolio.

- Not only style factors as illustrated here, but industry factors as well.

“… a global model would only view factor returns and volatility across all regions instead of recognizing returns are not completely correlated from one region to another…”